Morning Update | July 3, 2025 | The MidPoint

We are now officially halfway through 2025 and what have we learned?

Good morning, One South Nation!

Have a happy and safe holiday weekend — and a reminder to count your fingers after each firework.

The Midpoint of 2025

At the end of each month, the statistics are compiled for our MLS and the charts get updated — so I think you can probably figure out what today’s topic is.

A quick reminder, that unless otherwise noted, I am using resales of single family detached homes in the Richmond Metro area.

Median Price

Up, still — almost 5% YoY?

The median sales price of a home in RVA is now $450K. Unreal.

In March of 2020, it was $273K.

I do think it is interesting to note, however, that each year, the median price tends to peak in June and then fall for the remainder of the year.

This makes sense as the June sales data reflects what was happening 45-60 days prior which tends to be the frothiest months in any 12 month period.

If the seasonal patterns hold true, I would expect to see median price begin to slide somewhat as we move into the back half of the year — just know that seasonal and cyclical are not the same thing.

Median Price PER FOOT

On a per foot basis, more of the same — up over 4% from last June.

So ‘Shrink-flation’ is still the way of the market — higher prices for less house.

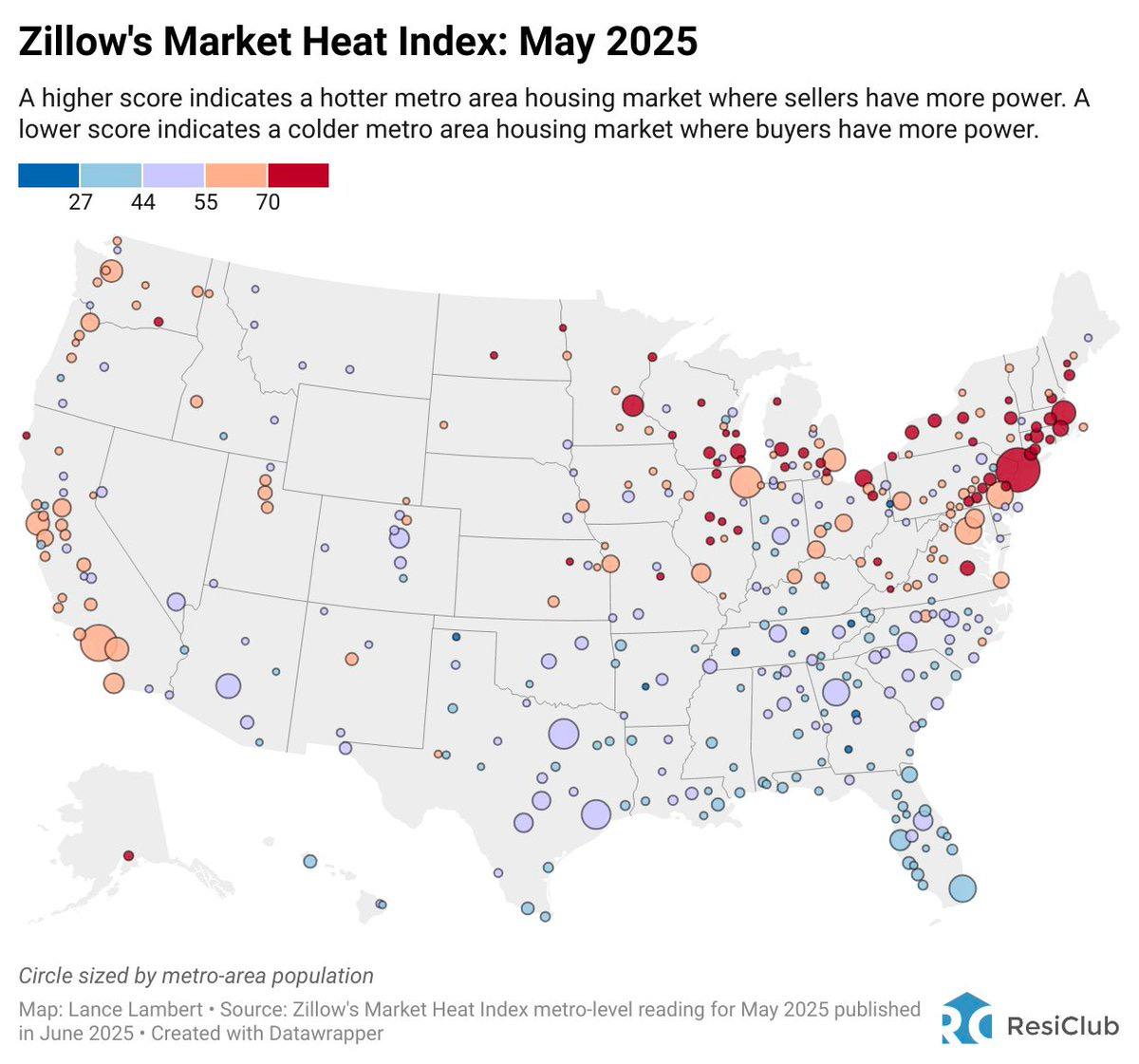

As we have talked about quite a bit, what is happening in other markets is just not happening here.

Days on Market

Yeah, still at or near all time lows.

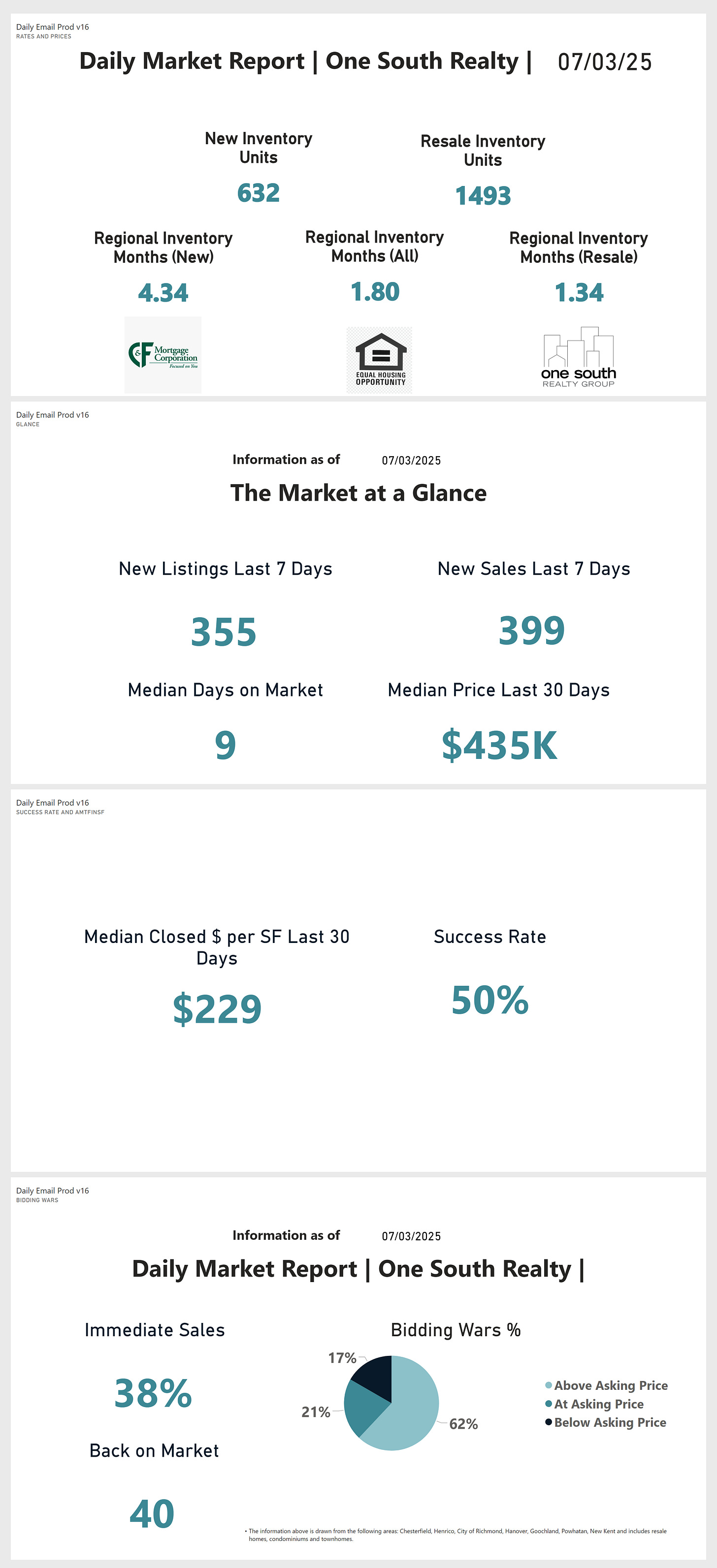

On our own Daily Market Report, the DOM moved back up from 8 to 9 days a week or so ago, which likely mean that the DOM for July will likely adjust, too. Regardless, the time it takes to sell a home is still quite short.

Think ‘Brian Scalabrine.’

Can you over price a home and have it sit around for a while? Of course.

But do properly priced homes still sell quickly and for more than ask? Absolutely.

Percentage of Asking Price

101.6%.

On the average, we are still over 100% (the median is 100% on the nose, by the way.)

Are we in the midst of bidding wars like 2021 and 2022? No.

But are sellers taking the discounts they took in 2008 or even 2019? Nope.

The overall trend is down for sure, but in the same way that 94 degrees feels like a cold snap when it has been 100 degrees.

Still nothing to see here.

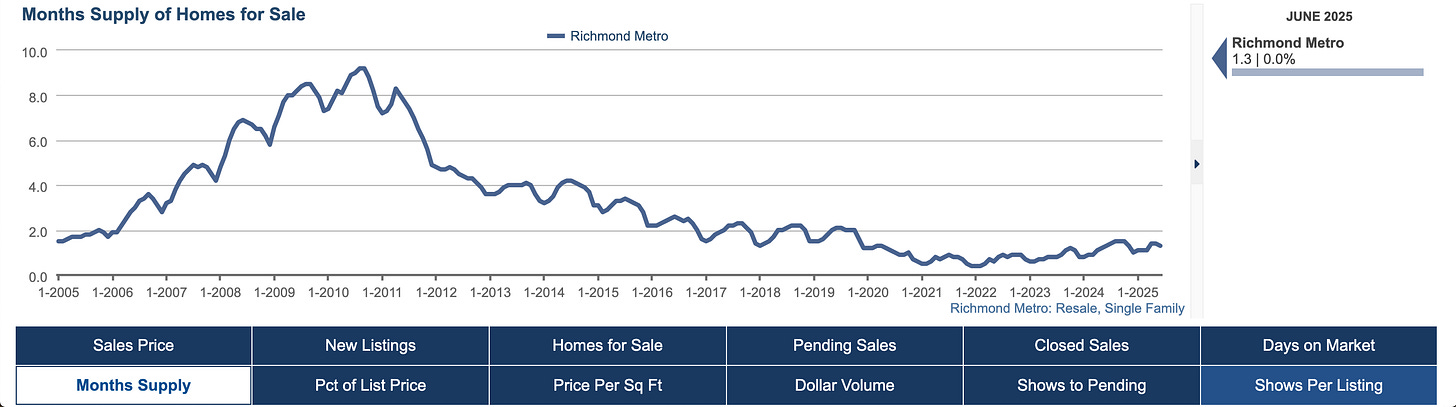

Months of Inventory

Still at or near all time lows.

I think we will see a jump in inventory come July (the Daily Market Report is showing roughly 1,500 resales now each week vs. 1200 back in April) but jump might be a strong word. Perhaps a slight nose up versus an actual jump.

Again, nowhere near a danger zone.

Overall

The first half of 2025 was still a banger here in Richmond.

While the rest of the country seemed to see some bigger shifts — especially in the southern states — those in the 804 continued to experience tight conditions.

So the good news is that owners are continuing to see their equity grow.

The bad news is that the buyers are still having to elbow other buyers out of the way — especially at the entry point.

Can the planning commissions of the world please get out of the way and stop turning down development? It is choking off the next gen of homeowners.

RVA Market

As noted above, the DMR is tracking the ‘tip of the spear’ metrics that are slowing to summer trends — which is to be expected.

Seasonal adjustments, yes.

Cyclical adjustments, no.

So even as we hit July, there were more sales than listings in the last 7 days and inventory remains less than 2 months.

Rates

Yesterday, rates ticked up 6 bps.

For the previous 2 weeks, rates had fallen by closer to 25 — a good trend indeed.

A month ago, the 30 year was just under 7% — and today we hit the ground running at 6.73%.

Surge might be a bit of a strong word, but some relief, perhaps?

The BBB

Trump’s controversial Big Beautiful Bill is slowly making its way through the House and should be put to a vote today (per reports.)

A lot of key voices are not fans as the bill is scheduled to add a LOT more debt to our already seemingly insurmountable debt burden.

That said, Scott Bessent (the Secretary of the Treasury and one of the seemingly sane ones) is on record stating the BBB will spur investment, and the additional debt will be more than offset by increases in tax revenue from the growth it should create.

Hmmmm … where have I heard that before? Oh, from every President ever about every single budget.

I’ll be curious to see what the markets think of it in its final form.

Content

I’ll close with a few quick vids / articles that hit my timeline this past week — some are witty and some are informational:

Rock, paper, scissors visualized

Feel free to share!

Stay safe this weekend.

‘Mureica.

Rick