Morning Update | May 12, 2025 | Market Bifurcation is Upon Us, and More Evidence of 'Shrink-flation.'

I'm using big words today.

Good morning, One South Nation!

Hopefully Mom enjoyed her flowers.

A Tale of Two Markets

It was the best of times (Virginia), it was the worst of times (Florida / Texas.)

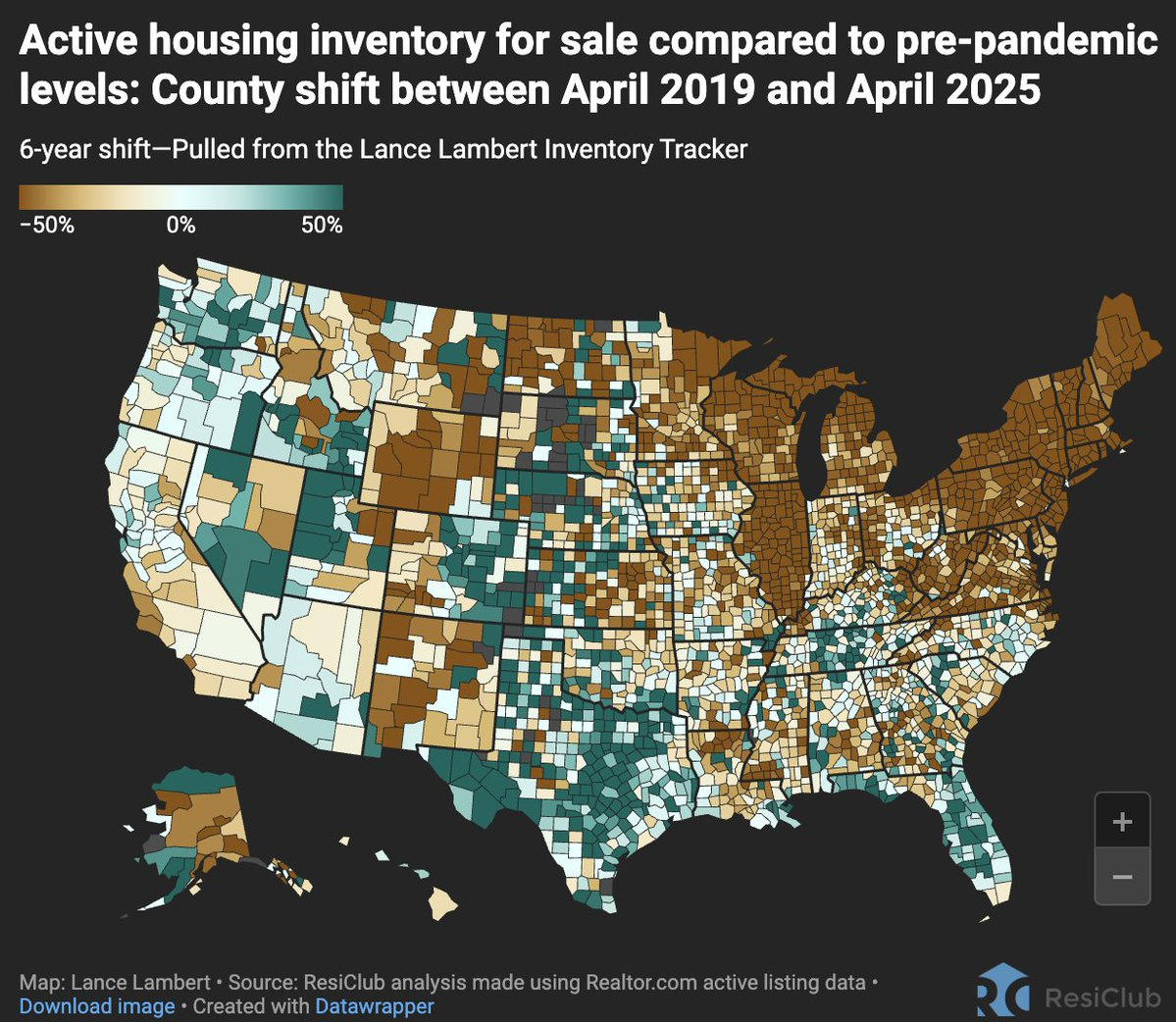

As we begin to transition from the spring to the summer markets, the US real estate market is splitting into two distinct camps — those with escalating inventory and those with scarce inventory.

Newsflash — RVA is in the scarce inventory category, along with most of Virginia and much of the Northeast.

If you hop on I95 and drive north, you just won’t see that many for sale signs.

But if you hop on I95 or I85 and drive south, the number of for sale signs rises. And when you get to Florida or Texas, the number of homes for sale increases dramatically — especially in new home communities.

(And I am not sure what happened to Illinois, that seems quite odd.)

Bifurcation

In effect, we have two markets emerging — those with excess inventory and those with stubbornly low inventory levels that just don’t seem to want to rise.

And it doesn’t seem as if a lot of areas are in the middle.

The difference? The inventory rich markets have the ability to build housing at scale, and that has taken a lot of pressure off of the market. Where you can build, prices have moderated. Where building is a challenge, prices have remained elevated.

In RVA, we are not an easy place to build, especially at scale — and so our prices have remained elevated and our inventory remains quite low.

Why aren’t we building more new homes? Our lot supply is low, our costs to build are high, and the scale of our communities is dwarfed by those in places like Florida, Texas, and Arizona.

→ Spoiler Alert — in the next few days we will dive deeper into new homes. ←

Rates

Rates have largely been staying in range recently — and by range I mean ‘below 7.’

I think this is a win, actually.

I never thought I’d believe that sub 7% is a ‘win’ but given the fact that we have the most uncertain set of trade relations ever, and are in the process of rewriting them with every trading partner, and the Fed really seems to have no idea what to do — the fact that rates haven’t moved much in the past 90 days is rather shocking.

And if this headline is reflective of what is coming, I’d expect markets to rally and possibly see rates trend down as well — especially if the rewritten trade deals help offset our deficit.

Relative calm and certainty are good things for rates, and if we can get some of the trade war / tit for tat tariffs out of the news, markets will get a better sense of where things are headed.

RVA Market

The big takeaway here is that we are on the third straight day of sales exceeding new listings, showing a net outflow of inventory from the market despite a lot of listings coming to market.

Traffic was a little bit light over the Mother’s Day + graduation weekend, but I still saw a lot of stuff pend.

I also find it moderately interesting that the Median Price is not really rising, but the price per foot is still at or near its high. I’d focus more on the price per foot to get a sense of what demand is doing to prices.

Think — ‘shrinkflation.’

Median DOM is still 7, so no early indications that the velocity of sales is slowing.

More soon on new homes.