Morning Update | December 7, 2024 | Jobs Report Moves the Rates (but why?), and the Headlines are Misleading

Rates made up a lot of ground yesterday, but the jobs report probably didn't warrant as much movement as we saw. And in case you hadn't noticed, I hate headlines...

Good morning OS nation!

Today is the first day where I am pushing out the update exclusively via Substack. Exciting times, indeed.

Rates

So yesterday was interesting in the mortgage market world and worth a little bit of discussion.

I’ll start with the end and work backwards –– rates fell, and fell hard.

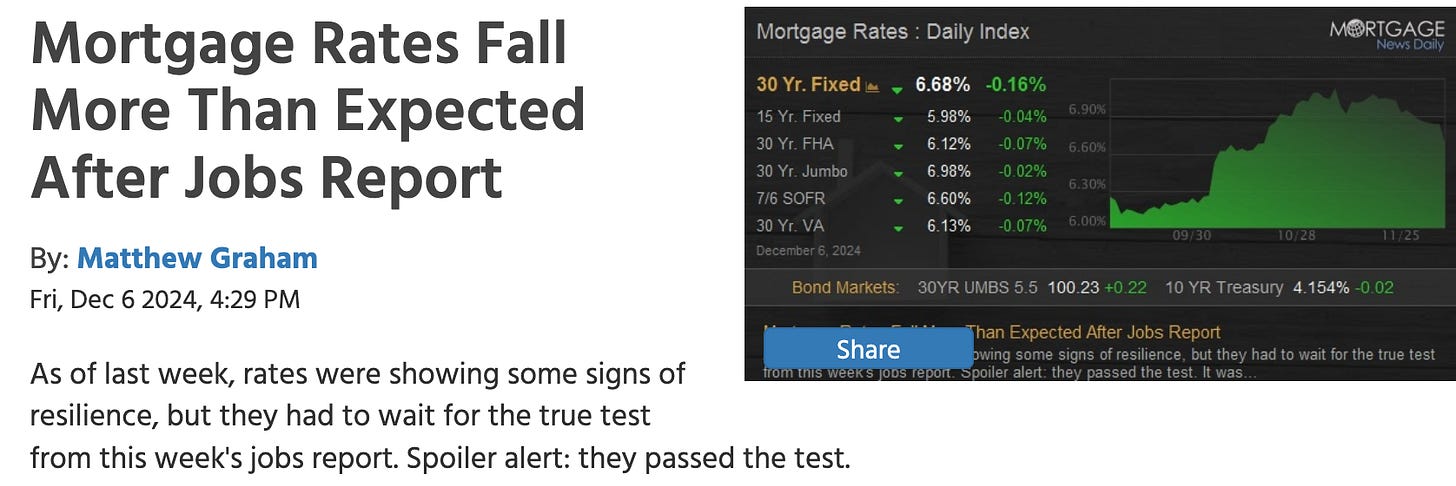

I’m not sure if the jobs report did it (perhaps?) or if it is some other market vagary that just isn’t apparent to a Realtor in Richmond, but the 30 year dropped by 16 bps from 6.84% all the way to 6.68%.

16 bps is a very big move for such an on-point / as-expected jobs report.

Other lengths / types fell, but not nearly as much, which again, seems to be signaling something that I am not quite picking up on.

That said, I’ll take it.

Jobs

What is interesting is that the jobs report should not have really triggered this much movement.

There was a small uptick in the unemployment rate (up to 4.2%), but the rate of new jobs was about as expected, and so what happened? Not sure.

It feels like the markets are poised to believe something about the labor market that isn’t necessarily reflected in the numbers, or at least how the numbers are reported.

Let’s see if the move holds next week with CPI and PPI getting reported. Irrespective of the new administration about a month away from taking over, we still have a country to run and about $36,000,000,000,000 in debt, and it will be closer to $37,000,000,000,000 by Inauguration Day.

So stay tuned.

Home Prices Nationwide

Ok, switching gears.

Some of the things that people are doing with data and data visualizations right now are pretty cool. Lance Lambert and Resiclub are one of my favorites by the way. His team does a tremendous job of marrying data and graphics in such a way that trends become far easier to see.

Pricing is Regional

Over the last year, there have been a lot of headlines about home price crashes and (using their favorite trick), media outlets (and other trolls) are trying to create a national narrative from a single market’s story.

To quote the great Naval Ravikant, ‘It is the media’s job to make one person’s problem into everyone’s problem.’

As you can see from the map above, there are some pullbacks in pricing over the past year in some markets, most notably in Texas and Florida, with some softness along the Gulf Coast, northern California and a few Sunbelt markets.

It’s Construction (and Migration, and Insurance)

Where has price appreciation remained high? Mostly in the Northeast and points immediately west (the ‘Rustbelt,’ mostly.)

Why?

Wherever new construction is easy, prices have moderated.

Wherever new construction is difficult, prices have remained elevated.

Yeah, that doesn’t explain No Cal or even Oregon (I’ll let you draw your own conclusions on those markets) but generally speaking, where you can get housing built at scale, you get price moderation.

Want lower prices? Build more.

Florida is a Unique Case

I think it is also important to add that Florida is getting pinched pretty badly due to the fact that they have built a lot of houses AND gotten slammed by back to back hurricanes that did a lot of damage in very short order.

Between the annoyance of having to flee the state several times each fall and the cost of insurance up between 3 and 5X, it makes sense as to why folks seem to be shunning / exiting those markets.

But here is the central point, the headlines that get pushed out by the under-informed make it sound as if the markets are all crashing all at once and at the same pace. Sorry, that is fundamentally untrue.

But 2008 …

Hang on, didn’t that happen in 2008? Didn’t prices fall everywhere and all at once?!?

For the most part, yes. Prices accelerated sharply everywhere from 2003 until 2007 (or thereabouts) and the fell everywhere from 2008 until 2011-ish.

Why? Because in 2008, the way homes were financed changed –– and that impacts everyone.

In 2006 anyone could get an ‘interest-only adjustable rate 100% LTV mortgage,’ even on second homes. By the summer of 2008, even Fannie and Freddie were refusing to make loans to buyers of primary residences.

When you change underwriting requirements, or remove wide swaths of loans from the available pool of lending options, everyone is impacted and all at once because nearly every buyer winds up in a Fannie, Freddie, FHA or VA loan product.

Whether you live in Virginia, Hawaii or anywhere in between, we all use the same basic loans. If you change / remove loan options, then everywhere gets impacted in approximately the same manner.

And that is 1000000% what happened in 2008. When the Sub-Prime loans popped, lending literally ground to a halt and no one could get a loan –– Fannie or otherwise.

No loans = no buyers = prices crash.

And once the negative feedback loop started, the foreclosures started and it took years to recover.

That is not happening today.

Supply and Demand are Determined Locally

Today, the reason a market may appreciate faster or fall quicker has to do with that individual market’s supply and demand –– not where or not FHA or Fannie will make a loan.

Right now, resale supply is down sharply due to owners with low mortgages refusing to sell (the Locked in Effect) and the only way to increase inventory is via construction. And so wherever land is plentiful, zoning boards conducive, and large builders present, homes get built and prices stop escalating as quickly.

It’s that simple.

Conclusion

So don’t let the headlines fool you –– what is happening there is not happening here.

When a client shows you a report about house prices falling, they have likely seen an article about TX or FLA or perhaps New Orleans, and the headline is using an individual market’s imbalance there and trying to draw a conclusion about all markets.

Don’t let them.

There is a saying in the military about how armies tend to prepare to fight the last war, not the next one. I think that lesson applies here –– the mentality is that 2008 will repeat itself simply because prices have gone up.

Not true.

If DC starts making wholesale changes to Fannie, Freddie, and / or FHA, then yeah, I could see big ugly storm clouds. But as for now, pay attention to new home inventory in your market to gain a sense of what home prices are likely to do where you live.

(And I may be writing a post about that very topic, so stay tuned!)

RVA Market

December of an election year is not the time to draw a lot of conclusions about market trends, but here is where we stand currently:

Enjoy the crisp day!

Rick