‘Doubt is not a pleasant condition, but certainty is an absurd one’ –– Voltaire

I will admit, I am a bit of an optimist.

Despite the ‘get off my lawn’ / ‘grumpy old man’ persona that I seem to increasingly project, I am still quite bullish on the future.

Anyone who works on commission, or owns their own business, or puts their capital at risk repeatedly has to be an optimist, right? If you are fundamentally pessimistic, then you would go work at the DMV.

I get it.

So I get a lot of side-eye looks when I continually push out blogs / updates that are fundamentally optimistic, especially into times when the overarching narrative is quite negative.

I guess I’m just a rebel.

That said, I also lived through 2008, so I am acutely aware that real estate is subject to market forces that don’t always push it higher. In 2008, I watched housing values fall some 30% in about 18 months … and there was absolutely nothing I could do about it.

Make no mistake, my optimism has a shadow.

Pricing is What Matters

First things first –– when it comes down to it, it’s about prices.

Yes, the number of home sales is what matters to Realtors, but the price of homes is really the only thing that matters to the public.

65.7% of the US owns a home, and thus the majority of Americans are outright giddy about what prices have done in the past few years. Even with some markets seeing some price corrections (Texas and Florida mostly), the large majority of US market’s price are still up some 30 - 50% from where they were when Covid arrived.

It’s been a good run.

Richmond?

Right now, pricing in Richmond Metro seems to be not only holding up, but still accelerating (well, 2025 is shaping up to be another positive year for home prices.)

So if pricing seems to be holding up, and inventory has not risen appreciably (like it has elsewhere), is there anything to be concerned about?

Of course.

Here is what is keeping me from sleeping soundly.

Fannie and Freddie Conservatorship Ending?

Back in 2008, Fannie and Freddie were ‘rescued’ by the Treasury in an attempt to keep them both solvent and lending money to the public to buy homes. Without a funding mechanism for housing, prices fall and fall quickly. Propping up Fannie and Freddy was a critical and necessary move IMO.

So for the past 17 years, Fannie / Freddie have been run by the Treasury Department.

What, Exactly, Do They Do?

Fannie / Freddie more or less back every mortgage that they underwrite, offering guarantee to the bond holders who buy the mortgages. Because of Fannie’s / Freddie’s guarantee, in the event of foreclosure, the mortgage holder will be paid in full (yeah, yeah, a gross oversimplification, I know.)

The role of Fannie and Freddie is essential to the US housing market, and one of the reasons that home equity is one of the primary savings vehicles for so many Americans.

What Happens?

If the Treasury spins them back out of conservatorship –– especially if the guarantee is somehow eliminated or modified when they do so, what would that do to mortgage structures?

I don’t like the thought.

My primary concern is that if a) they push Fannie and Freddie back out into the private sector, and if b) they simultaneously eliminate the government backing (guarantee), then we could easily see the end of the 30 year fixed rate mortgage AND we would see an immediate / permanent jump in rates.

Not cool.

Pricing for housing is based on the current mortgage structures and guarantees, and anything that could cause a national reset in pricing feels very risky.

The good news is that the new Treasury Secretary, Scott Bessent, is on record as saying that the Treasury will not spin Fannie and Freddie back out if it will impact rates, but I know that the current administration is anxious to downsize the government and remove what it considers unnecessary risks.

Fannie / Freddie are an obvious part of that conversation.

Fear Factor –– 30%

DC Recession / Housing Crash

Leave it to Twitter to take a single fact with little to no context, and spin it up into a tornado of fear.

(I am admittedly guilty of ‘doom scrolling’ Twitter and getting myself worked up for no reason, too. I need to be better about allowing Twitter trolls to suck me in, but that is for another post.)

Right now, the housing bears are all over the narrative that the D.O.G.E. team’s audits / downsizing of government agencies is causing mass unemployment in the DC Metro, and it is manifesting itself as thousands of new listings coming to market.

Per the actual experts (not the self-proclaimed ones), the overall DC market is not collapsing. Some segments are seeing more inventory than one might expect at this time of year, but calling it a collapse is extremely premature.

But could it?

The Rust Belt of Government

Any area that relies so heavily on a single industry is subject to recession when the industry itself suffers a recession (think ‘Rust Belt’ cities when the US shipped manufacturing overseas,) and so the idea that DC could experience a real recession (along with home price decline) isn’t that far-fetched.

How would a DC housing recession impact Richmond? I don’t think it would be helpful, but I don’t think it would be the market altering event that the doomsayers might suggest, either.

Richmond is a less expensive alternative to DC / NoVA and if prices there were to fall in and around the District, it could have an impact on the rate of migration south (think –– ‘lower demand.’)

To illustrate how far we have come:

In 2000, the median priced home in the DC region was 45% more expensive than RVA

Today, it is closer to 35% higher

We have closed the gap substantially, but RVA still is a bargain when compared to the NoVA market.

Regardless, RVA is so undersupplied (studies show we are 15K to 20K new homes below where we need to be,) slower migration from NoVA to RVA doesn’t seem overly concerning.

Furthermore, the DC region, even if it hit with some extra supply as unemployed workers exit the region in search of jobs, the lack of homebuilding / lot supply inside the beltway will mitigate the impact of higher resale inventory

Demand > Supply both here and there.

Fear Factor –– 15%

9% (or Higher) Mortgages

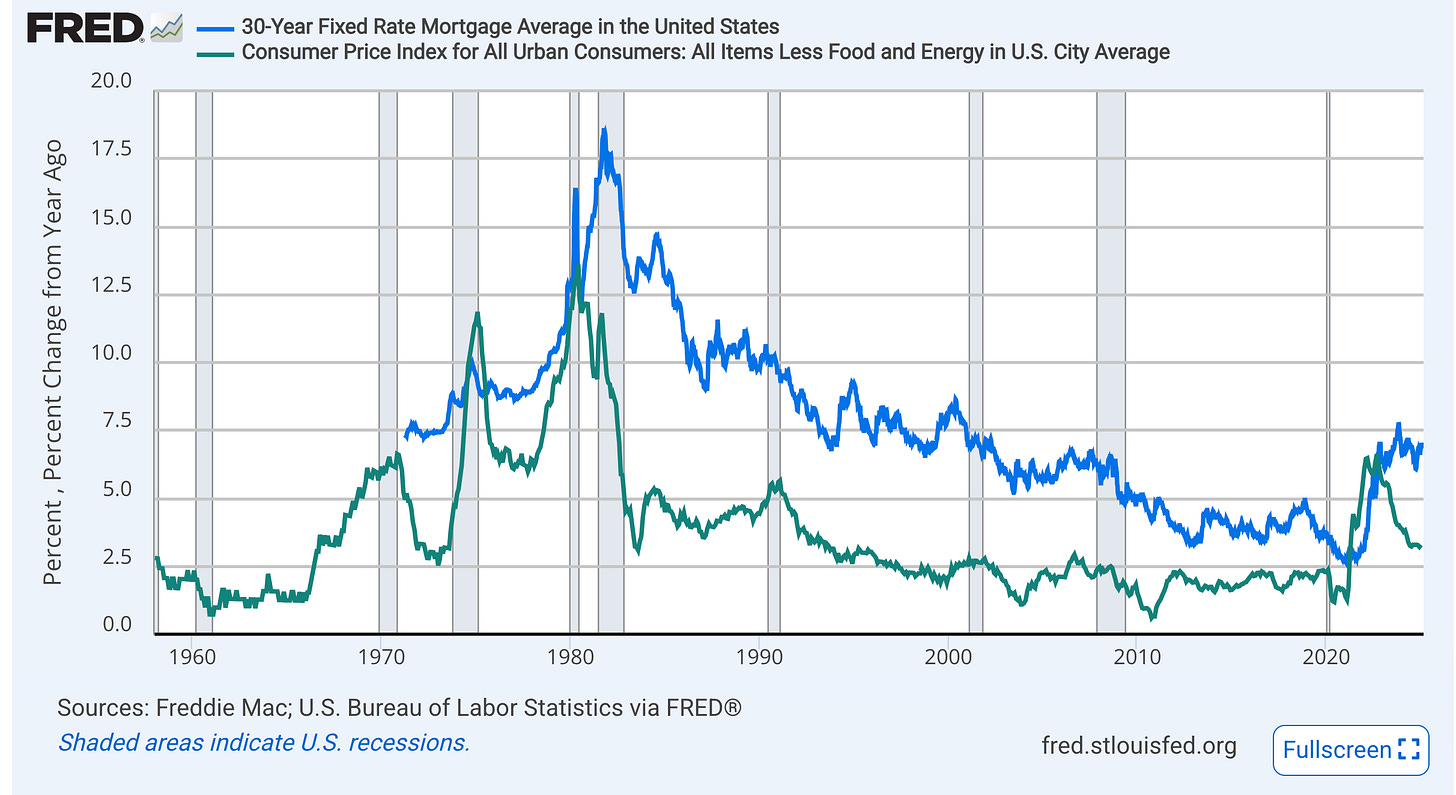

It is no secret that rates, especially longer term rates (think ‘mortgages’), are heavily influenced by inflation –– or at least the expectation of future inflation. When the markets expect inflation to increasingly degrade the value of money over time, lenders charge a higher rate to offset the loss of buying power of the money they lent.

Debt = Inflation

So what causes inflation?

Tariffs can cause inflation, supply chain interruptions can, as can trade wars –– at least in the short term.

And those are all very real and present dangers.

But the biggie is the debt owed by our government –– which is currently $36T and rising (by EOY 2026, the debt is projected to be $38T.)

When the government is heavily indebted AND it continues to run a substantial deficit, bad things happen:

It needs to borrow more to operate, which takes money from the private sector and slows investment and development

It has to pay interest on the existing debt which crowds out day to day operational needs

Currently, our interest payments are at / near the same amount we pay for national defense!

Annnnnnnndddddd it needs to refinance the existing debt when it comes due

Ouch.

Of course, the US can also go into the back room and turn on the money printing presses, right? Just fire up the printers and pay the debts with some crisp new $1T bills, right?

Yeah, printing money causes inflation as well.

Solution?

So what can we do?

Tighten the belts and stop spending like drunk sailors on shore leave.

Any time you cut spending it means sacrifices –– which causes consternation amongst those who are affected most. Everything seems essential when it comes time to cut the budget, and anyone who relies on the spending (either recipient or employee) gets upset.

I don’t think that it is a stretch to say that cutting spending in this political environment will be:

Polarizing

Politicized

Controversial

Annoying

Disrupting

Or all of the above

But we have gotten to the point where doing nothing isn’t an option any longer.

We Cannot Default on Our Debt

If we do not change, we run the very real risk of default on our exiting debt, and that will be worst of all possible outcomes. Default of US debt means rates go parabolic and the world goes into a deep recession / depression.

That. Cannot. Happen.

Rates will fall meaningfully if / when we get spending under control and figure out a way to shrink the debt without using the money printing presses.

Fear Factor –– 50%

The Loss of Insurance

The last few years has not been good for the property insurers.

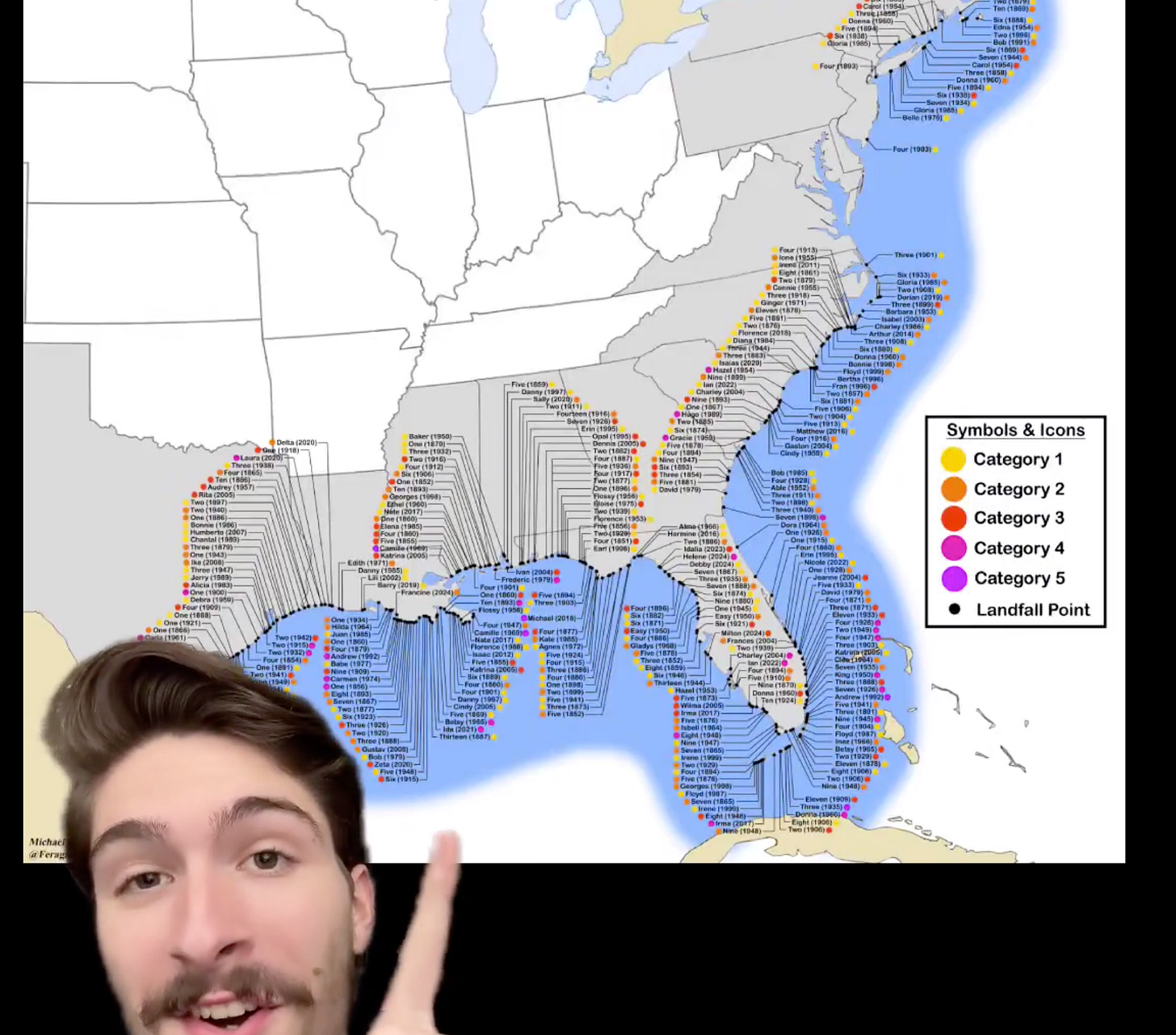

Fires in California and Hawaii, hurricanes hitting Florida from seemingly every direction (and flooding out the Carolinas), and a condominium collapse in Miami have led to some serious payouts.

Recently, insurers have said ‘no mas’ and are withdrawing from states where the risk is high yet the premiums are capped by the state’s insurance commissioners. Capping premiums seems like a good way to keep premiums low, but when risk > premium, insurers simply leave the market –– meaning insurance becomes un-available.

Note that I didn’t say ‘more expensive,’ I said ‘unavailable.’

No bueno.

Virginia is Largely Spared

The good news is that Virginia is one of the cheapest states in which to insure property, largely due to the fact that we don’t get hit by massive weather events (or catch on fire) in the way the gulf states / California seem to.

Call it a quirk of nature, but Virginia (and Maryland) have somehow escaped the direct hits from hurricanes for as long as they have been tracked.

Pooling Risk

But any insurance relies on spreading risk over a large pool of insureds, and even though the hurricane lands in Fort Lauderdale or Boca, the cost gets spread over everyone.

While cost to insure structures in Virginia is low, it is on the rise if for no other reason than we all share the risk. The nature of insurance is that the costs here reflect the disasters there, so we all pay more when entire cities burn down, even if they are 2,600 miles away.

And a quick reminder –– mortgage payments are driven by paying Principal, Interest, Taxes, and INSURANCE. As insurance costs rise it impacts overall affordability and it impacts qualifications. Buyers literally qualify for less, which isn’t helpful.

Richmond isn’t Miami so the impact is not as dramatic, but homeowner’s policies here are not getting cheaper, either.

Fear Factor –– 20%

Summary

I could have gone on a lot longer, but I’ll wind it down and save the other issues (general recession, more war / terrorism, tax code changes / elimination of Mortgage Interest Deduction, Covid 2.0) for another post.

Right now, the factors for me that drive pricing are (and will always be) supply and demand:

Supply remains low with very little single family construction and an extremely low (and extremely expensive) lot supply

Demand continues to outstrip supply at almost all price points due to migration and demographics

Irresistible force, meet the immovable object.

The key thing to remember is that we can’t just snap our fingers and create thousands of building lots (especially not affordably) and we know that the demographic bulge exists all the way down to those who are between 15 and 20 years old.

In other words, the primary way to solve the problem is to build more, and that solution has proven to be essentially impossible. Laws won’t allow it and the existing infrastructure can’t handle it.

For RVA, undersupplied will be the new normal, and it will be this way for decades.

Even if some of the worst case scenarios do come true, the impact here will be less than the impact elsewhere, which will mitigate the damage.

IF we can get the debt / spending issues solved (and that is a very big ‘IF’), everything else is noise.